Insights

2023 Fourth Quarter Review: Inflation Declined and Unemployment Remained Low

The stock market climbed a mountain of worry in 2023, surprising most investors who were concerned about a recession. The MSCI All Country World Index rose by 22.2% and S&P 500 Index increased by 26.3%. At the start of the year consensus had believed:

- the rapid increase in interest rates in 2022 would slow the economy;

- an economic slowdown would be necessary to significantly reduce the rate of inflation;

- and corporate earnings would disappoint, leading to lower stock prices and job losses.

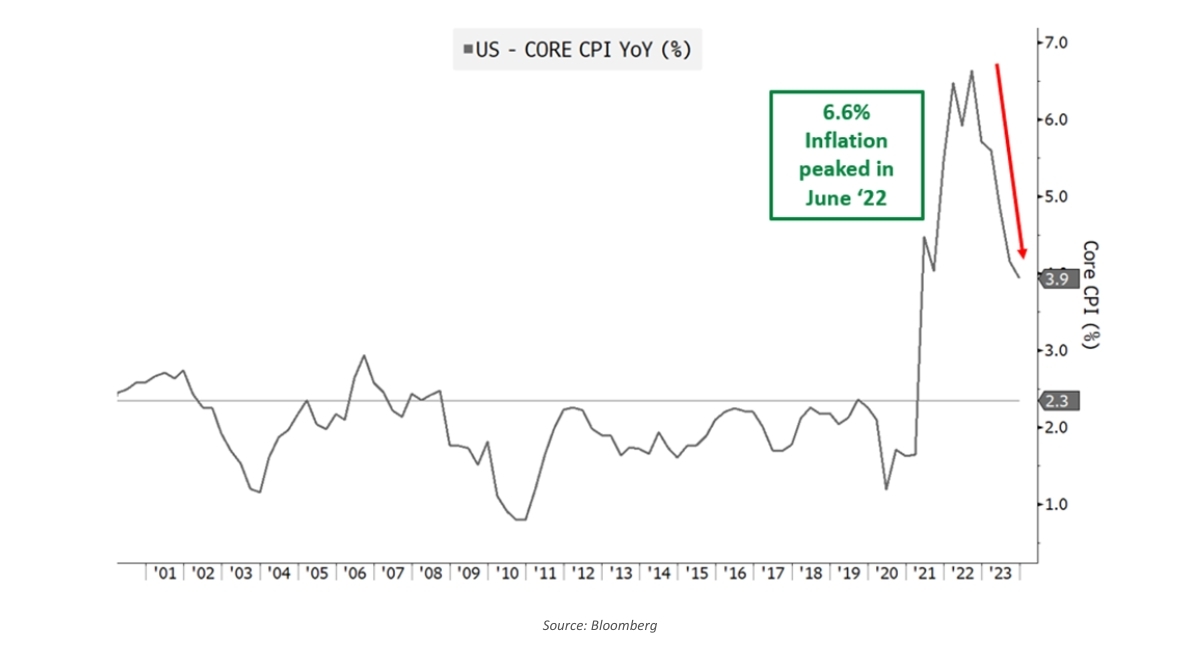

As it turned out, many investors were caught flat footed when inflation declined and unemployment remained low, while the economy and corporate earnings remained resilient and picked up speed. US gross domestic product accelerated with growth of 4.9% in Q3 year over year (up from 2.1% in the second quarter.) While economic growth surprised on the upside, inflation (see chart below) continued to decline.

The lesson for investors is that the consensus is often wrong. There are limits to any forecast, and forecasts need to be continuously reassessed and adapted with any shifts in new data.

The Fed Tames Inflation

The Federal Reserve (“Fed”) appears to be achieving the fabled “soft landing” by lowering inflation without shrinking the economy. When the Fed implied in October that interest rates may be peaking, stocks and bonds rallied strongly through December. The Bloomberg Aggregate bond index rose 6.8% in Q4 alone, preventing bonds from having a 3rd consecutive year of negative returns; the S&P 500 Index increased by 11.7% in the quarter, while small cap stocks rose by 14% in the quarter.

Chart 1: Inflation is now well below the peak levels seen in 2022

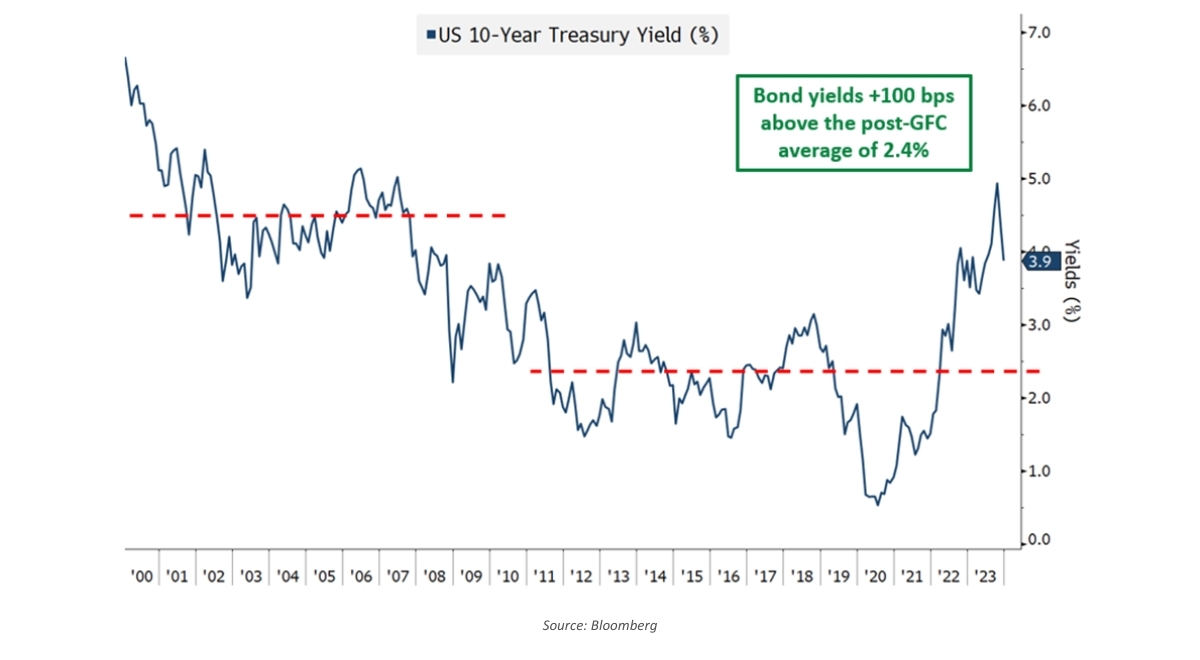

After the Global Financial crisis, many investors worried that perennially low interest rates signaled the economy was operating below its potential. Though the response to COVID spurred inflation, it also boosted the economy. As a result, we now see yields at levels not seen since prior to the financial crisis.

Chart 2: Bonds yields highest in fifteen years

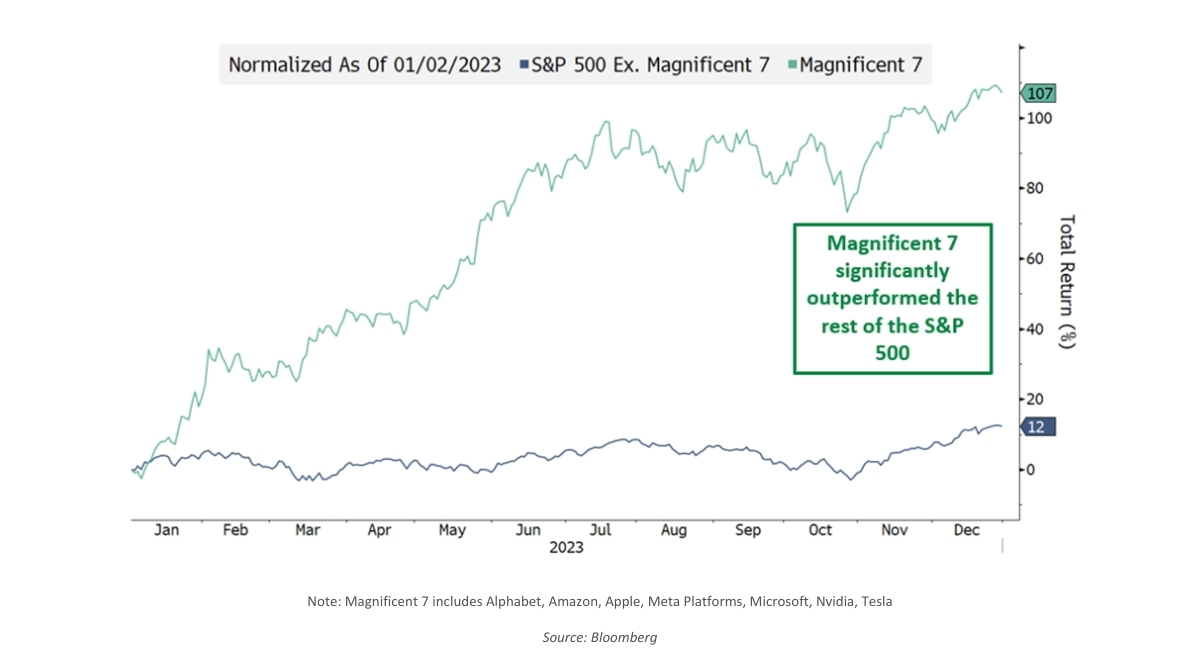

Artificial Intelligence: Accelerating but Unpredictable

A further catalyst to stocks is the rapid development in Artificial Intelligence, which provides investors with glimpses of huge new opportunities for certain AI-focused technology firms. This propelled gains for the ‘Magnificent 7’ tech companies, which now represent over 25% of the entire the S&P 500 Index, and their remarkable performance lifted the performance of the whole stock market.

Chart 3: Magnificent 7 (NVIDIA, Apple, Microsoft, Alphabet, Meta, Amazon & Tesla) vs rest of market

Many investors believe that the adoption of AI will transform many lines of work and improve productivity in fields like finance and medicine. However, the actual adoption of AI may defy current industry forecasts, and we expect that complexity and potential regulation will continue to affect its usage across the economy.

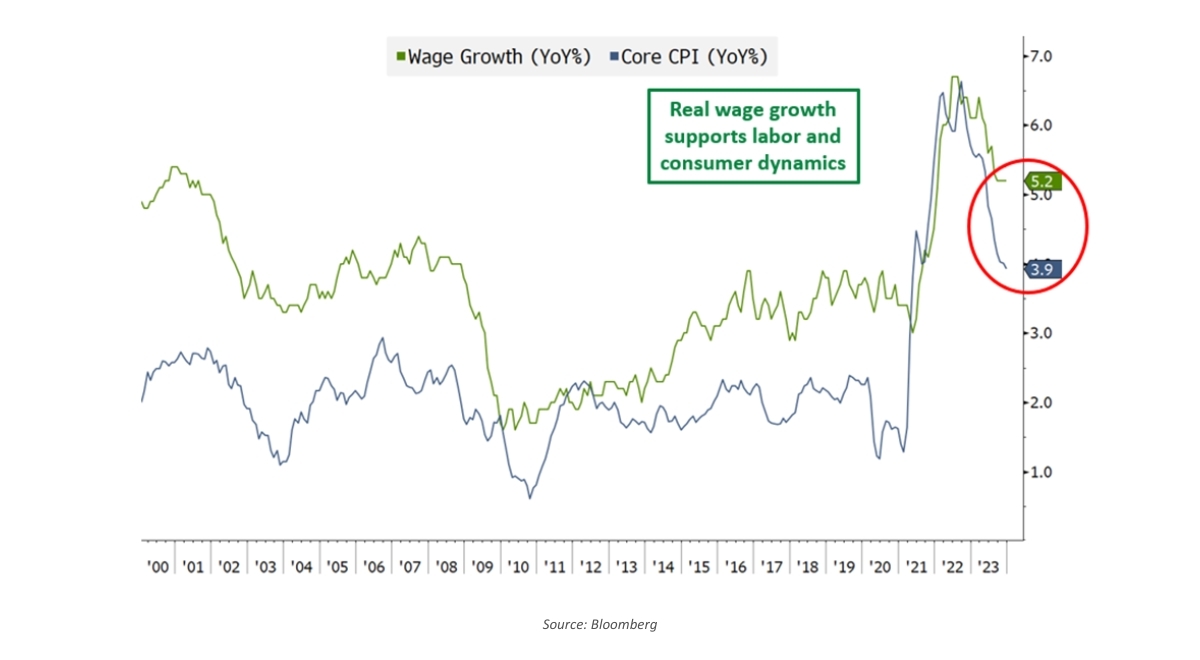

2024 Begins with a Strong Market and Economic Backdrop

Stocks are near all-time highs, and the economy is in good shape: Unemployment is low, wage growth is in excess of inflation, commodity prices are easing, and many industries are beginning to recover from their post COVID/Stimulus hangover.

Chart 4: Wages growing - real wages (wages minus inflation) above inflation

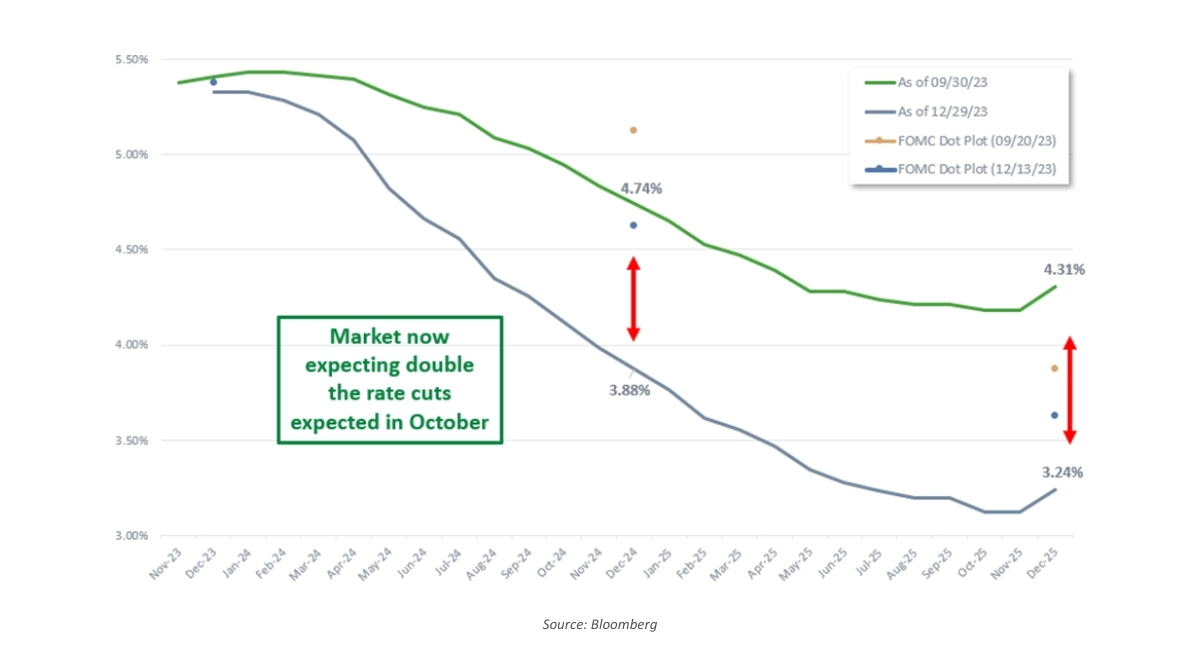

Investors are bullishly forecasting that the Federal Reserve Bank will cut interest rates several times in 2024, but we caution that these forecasts have proven to be poor predictors of actual interest rate changes.

Chart 5: Forecasts change quickly - expectations of rate cuts shift over time

Balancing Unemployment and Inflation

As a reminder, the Fed has a dual mandate: 1) to keep inflation around 2% and 2) to maintain full employment. Achieving both goals simultaneously is very elusive as full employment generally spurs inflation. Over the past two years, inflation was high and unemployment remained low. Now that inflation is moderating, the Fed can lower interest rates to stimulate the economy in response to a potential rise in unemployment.

As a result, lower inflation is boosting investors’ confidence that the Fed might consider lowering interest rates to support economic activity and reduce the debt interest burden on consumers, businesses and state and local governments. In addition, lower interest rates would support higher equity valuations and long-term planning by reducing the discount rate on future cash flows. Investor optimism in 2024 is fueled by expectations that the rate of inflation is declining and that the Fed will be able to focus more on maintaining full employment.

At present, earnings visibility looks decent for the first half of the year. However, a key contrarian risk for 2024 is that inflation might reaccelerate. This would force the Fed to keep rates high, potentially putting the economy at risk. In addition, if there are significant job losses, this would lead investors to reassess their operating expenses and household spending. Therefore, monthly unemployment and inflation figures will be closely watched, and we will make adjustments to our portfolio positioning as expectations shift.

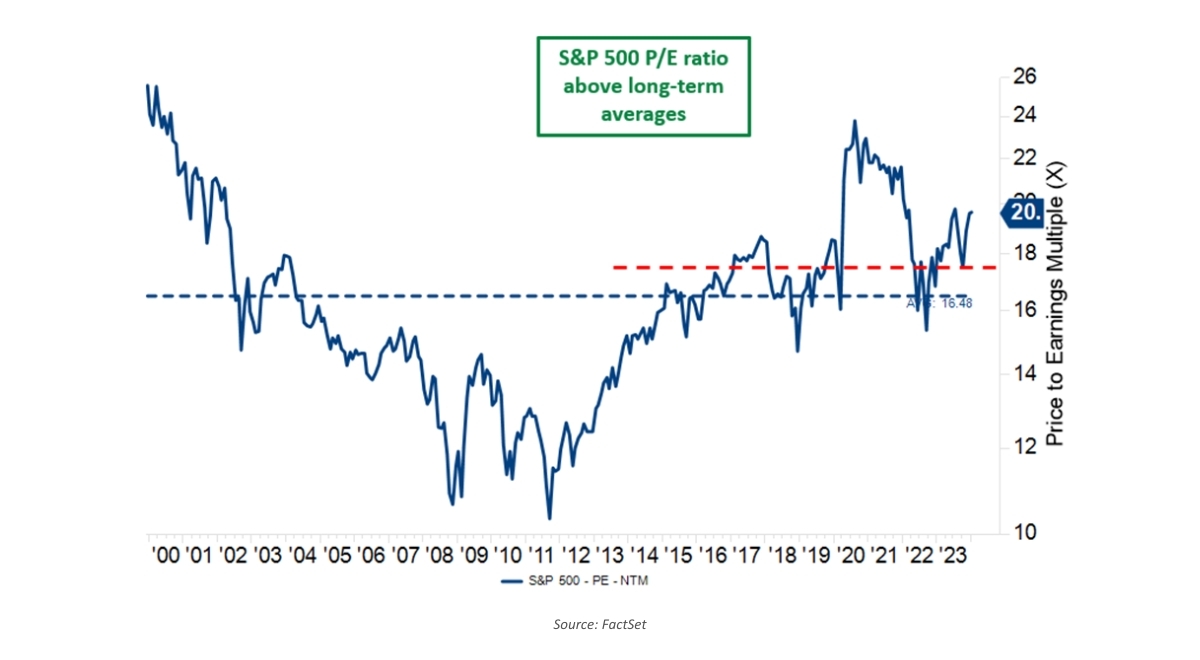

Of course, there are geopolitical risks to consider in 2024. The contentious US presidential election in November will certainly be on investors’ minds. In addition, there is armed conflict in Ukraine and expanding combat across the Middle East, as well as continued tensions between the US and China. Still, economic fundamentals are solid, and company earnings are beginning to trend upwards. Yet, market valuation remains above long-term averages.

Chart 6: High Valuation - S&P 500 price to earnings multiple

Our baseline 2024 assumption is that we will see a relatively “average” year for stock returns that match 4%-7% earnings’ growth (plus dividends) – and will not go higher because of relatively high current valuations. Fixed income bonds currently yield around 4%-5%, which is the highest income yields in over a decade.

We look forward to hearing from you so please reach out with any questions, and we hope to update you on your accounts and our outlook for the next year.

Best regards,

The ChoateIA Investment Team