Insights

COVID-19 Update: Assessing Volatile Markets

Last week was the worst in the markets since 2008, with the stock market falling 15% in a single week. As of Friday, stocks were down approximately 30% for the year. The Choate team remembers 2008 well. We have been reflecting on that experience as we prepare ourselves and our clients for another volatile and challenging period, and are grateful to have the lessons of that crisis to draw upon now.

As in 2008, market swings have been dramatic. Stock markets have recently moved up and down several times by around 10% (a year’s worth of returns) in a single day. The market has begun to resemble a casino rather than an orderly value discovery mechanism. This reflects the unprecedented and highly uncertain prospects of a modern globalized consumer-based economy facing a global pandemic that will require large-scale lockdowns.

As mentioned in the last update, we are closely watching three key variables: 1) how much further will the virus spread and what measures will be necessary to ultimately contain it? 2) how much negative impact on supply and demand will these measures create? and 3) how large will the offsetting fiscal stimulus be, and when will it arrive?

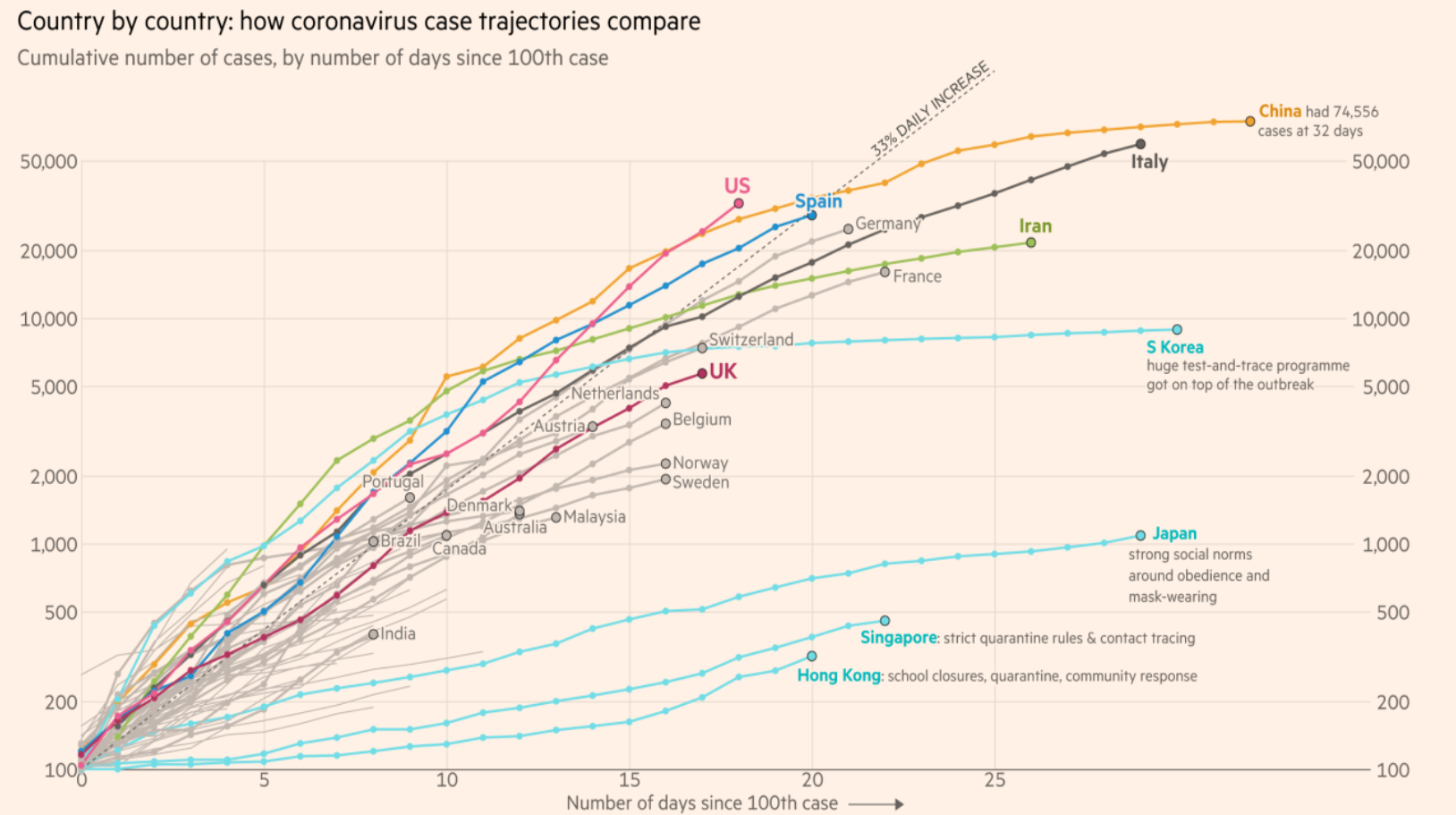

Unfortunately, developments on the first two factors are daunting, and we are therefore maintaining our defensive investment posture. The virus has spread widely and has already created significant economic costs. It is clear that the United States is on a steep trajectory with many other Western nations:

FT graphic: John Burn-Murdoch

Source: FT analysis of Johns Hopkins University, CSSE; Worldometers. Data updated March 22, 2020.

With regard to the third factor of stimulus, we never thought we would be grateful for 2008, but it did teach the Federal Reserve valuable lessons about managing a severe financial crisis. The Fed has been quick to act, and the lessons of 2008, so painfully learned, are being applied aggressively. One can only imagine how much more challenging the economic situation would be if the Fed had not been through the experience of 2008.

In the current crisis, the new learning will be about fiscal policy. Policymakers are wrestling with the unique challenge of attempting to temporarily shut down large parts of the economy for a period of time for the sake of public health. California, which by itself is the world’s fifth-largest economy (about the size of the UK), is under lockdown. It is encouraging that the proposed fiscal stimulus is now being measured in the trillions of dollars, as a massive scale will be necessary to replace lost demand and minimize the second-order effects of social distancing. As with monetary policy in 2008, we expect to see ongoing fiscal escalation as measures once thought to be overwhelmingly large prove to be insufficient.

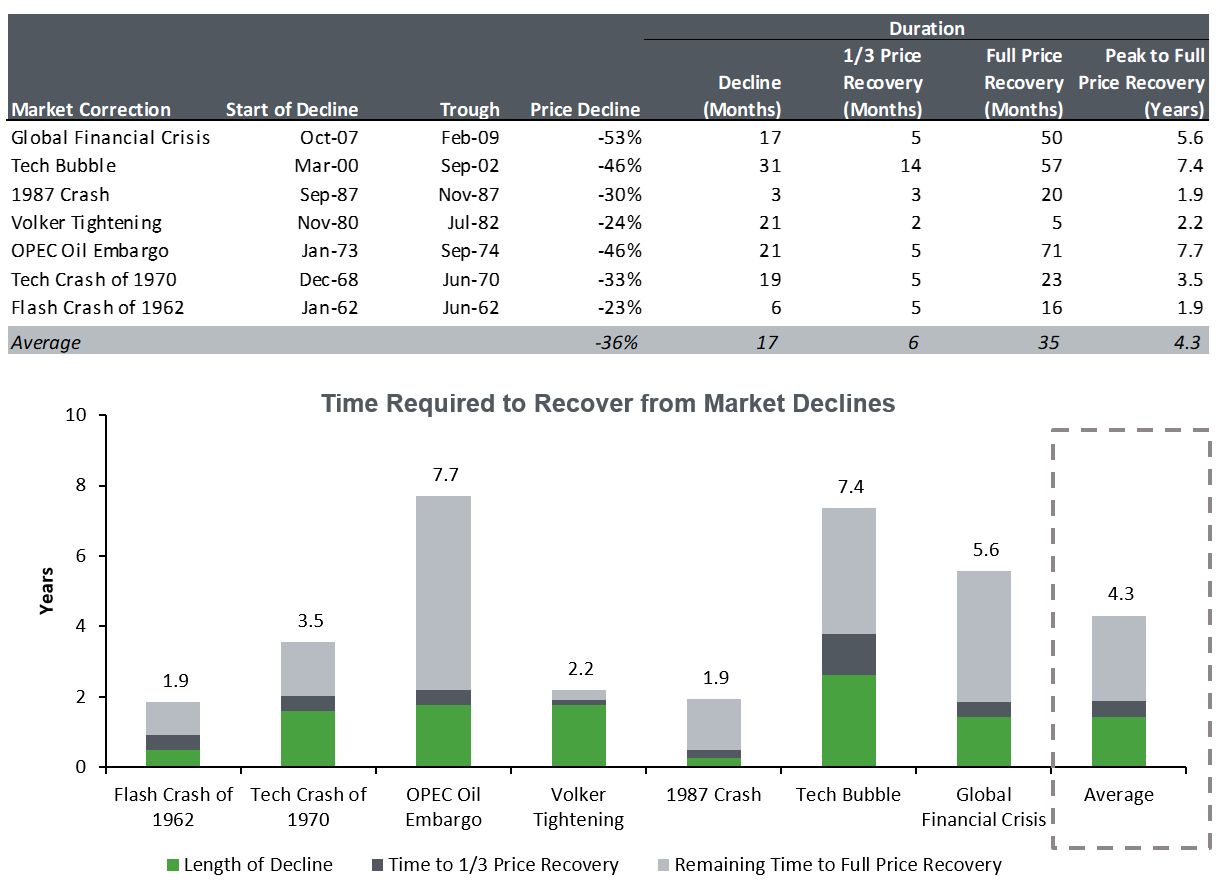

To put the dramatic market volatility into context, we analyzed past instances where the market fell by more than 20% going back to the 1960s. The table below summarizes these major declines, which happened in almost every decade:

Source: Bloomberg; uses monthly price returns from 1962 through 2018 for the S&P 500 Index.

The average time the market took to recover from these major declines was just over four years, and one-third of the loss was recaptured an average of six months after the market bottomed. We remember that some days in 2008 felt completely overwhelming, but one important lesson from that time was that it eventually ended. This will also end, and the resilience of the American economy will again be demonstrated, as it has in the past. To quote John Stuart Mill’s 1848 work, Principles of Political Economy:

What has so often excited wonder [is] the great rapidity with which countries recover from a state of devastation; the disappearance, in a short time, of all traces of the mischiefs done by earthquakes, floods, hurricanes, and the ravages of war. An enemy lays waste to a country by fire and sword, and destroys or carries away nearly all the moveable wealth existing in it: all the inhabitants are ruined, and yet in a few years after, everything is much as it was before.