Insights

COVID-19 Update: Reviewing Market Volatility

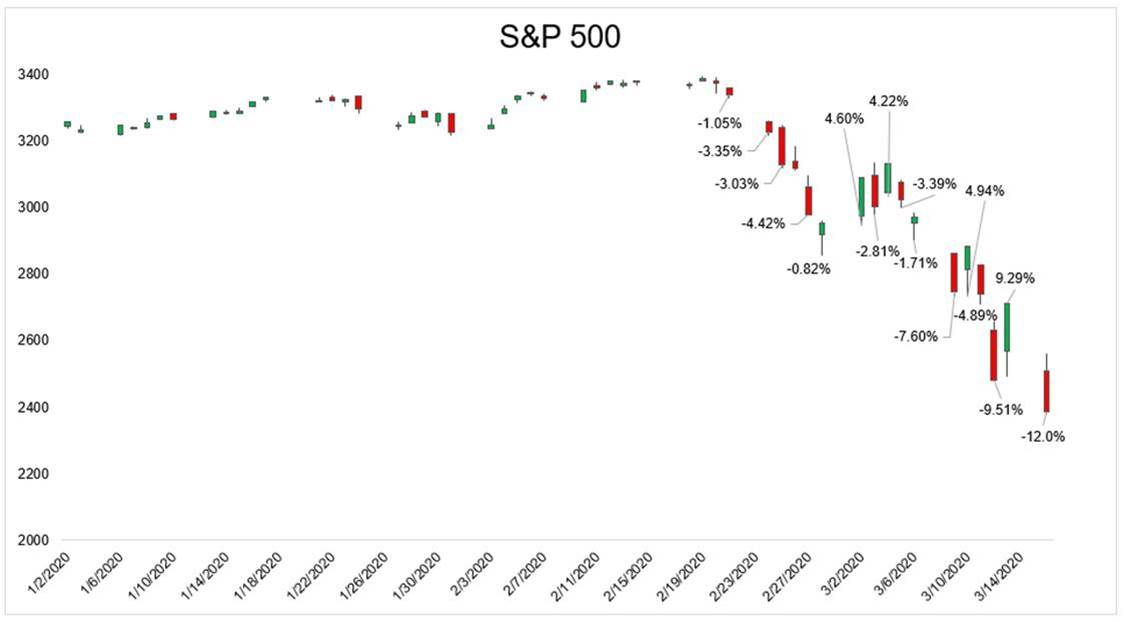

Monday was another market milestone, with the Dow dropping almost 3,000 points in a single day. Monday the 16th displaced Thursday the 12th as the second-largest one day market decline ever. The chart below shows how much market volatility has picked up in the wake of the spread of the coronavirus. There have been strong market gains in this sudden bear market as well as sharp declines.

Market swings of such magnitude are a manifestation of the very high level of uncertainty that investors face. Three crucial variables remain unclear:

- how much further will the virus spread and what measures will be necessary to ultimately contain it?

- how much negative impact on supply and demand will these measures create?

- how large will the offsetting global fiscal stimulus be, and when will it arrive? Until there is more clarity about each of these three questions, market volatility will remain high.

With regard to the first question, containment in the US is currently being done in patchwork fashion at the state level and testing is still very limited. Several states with large populations, such as Texas, have so far done little to encourage social distancing to slow the spread of the contagion. With regard to the second, the “demand shock” caused by the virus could be very large. The US is overwhelmingly a services-based economy, and many of these services involve personal interactions (e.g., dining at a restaurant, visiting the dentist, going to the gym). Even when the virus abates, much of the foregone demand for these services will be a deadweight loss. Consumers will not increase their consumption to make up for the past, and in the wake of this virus outbreak, consumers may be reluctant to spend. They may, for example, fear being laid off and wish to build up their savings. Fiscal stimulus is therefore vital, particularly to offset the second-order effects of the crisis and prevent a cascading decline in consumption (e.g., the bartender who is no longer getting tips can no longer pay his rent or afford new shoes).

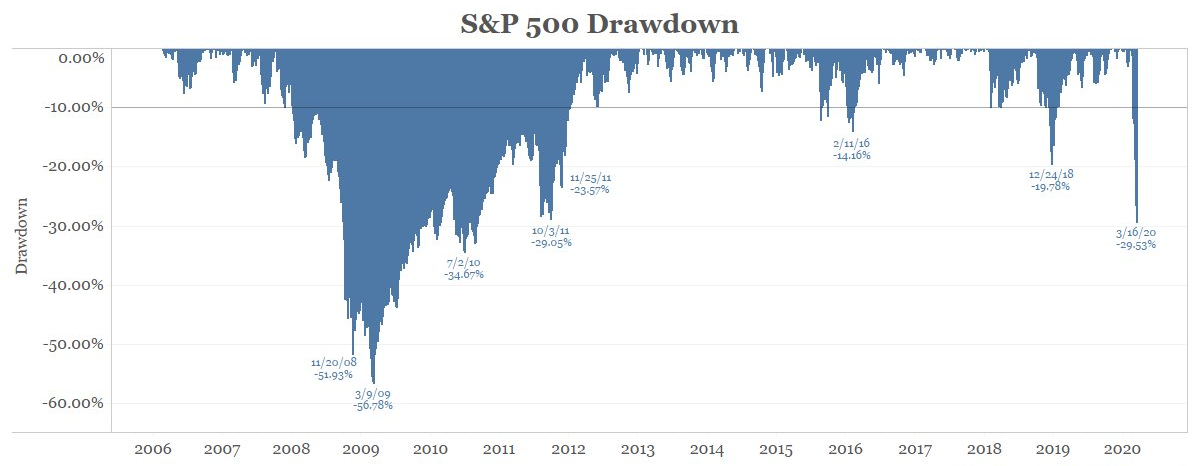

The market has never fallen this far, this fast. The chart below illustrates the record-setting pace of the descent into a bear market of the past weeks:

Source: Bloomberg

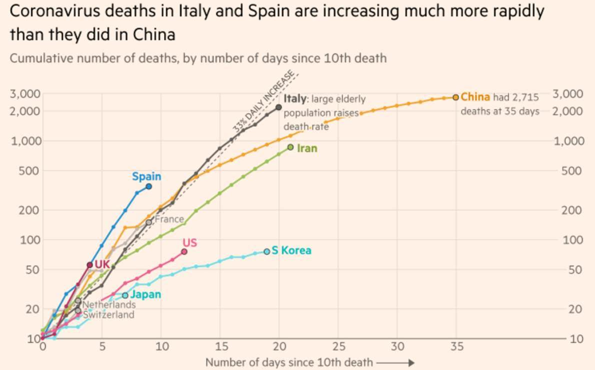

In such a volatile and uncertain environment, it is important to resist the temptation to make sudden changes to your long-term investment strategy. This is not a market to “trade.” Experience in past crises shows that it is best to continue to follow your plan, rebalance and stay disciplined. This is of course difficult to do in practice. As I mentioned in my update last week, we are cautiously looking for opportunities, but we will be patient until there is greater clarity about the impact of the virus. The recent experience of Italy remains our model for the future in the US, unfortunately. Most western countries are on a similar, alarming trajectory at this point. It is quite possible that the impact of the virus will increase rapidly and further lock downs will be necessary.

FT graphic: John Burn-Murdoch

Source: FT analysis of Johns Hopkins University, CSSE; Worldometers. Data updated March 16, 2020.