Insights

COVID-19 Update: Navigating an Uneven Market

After plunging in March, the stock market bounced in April and is trading flat so far in May. There is a strong case that the stock market is well ahead of underlying economic fundamentals, which remain abysmal. For example, last week we learned that U.S. retail sales fell by a staggering -16.4% in April, well in excess of economic forecasts. Since the March low, the S&P 500 index is up +28%, but future corporate earnings estimates for the remainder of 2020 and for 2021 continue to decline.

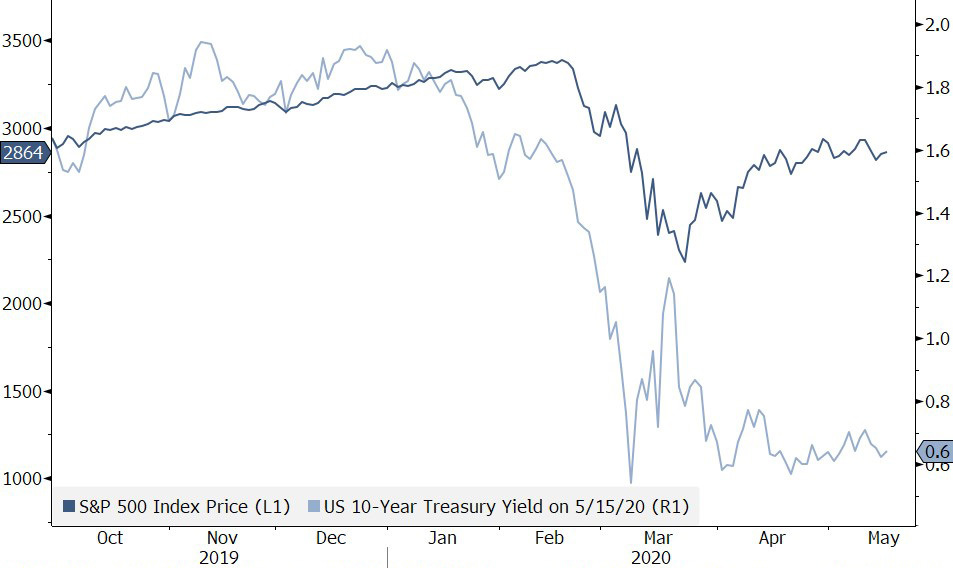

In the aggregate, stock investors seem to be counting on ongoing extraordinary fiscal and monetary stimulus, and are looking past current earnings and hoping for a resumption of rapid earnings growth in 2021 and a return to trend by 2022. Bond investors, by contrast, appear to be skeptical of a rapid recovery. Yields on the 10-year Treasury remain close to all-time lows and have not moved higher with the stock market bounce. Yields of only 0.6% for U.S. 10-year Treasury bonds are not consistent with a quick return to trend line economic growth. As you can see from the chart below, bond yields (light blue line) and the stock market (dark blue line) moved in tandem from October to March, but recently bond yields have stayed flat while stocks have risen.

Source: Bloomberg

A deeper investigation, however, shows that only certain sectors of the stock market have recovered, while other industries still trade near their market lows. This indicates that the stock market is not necessarily forecasting a rapid economic recovery and the stock and bond markets are more aligned than they appear on the surface. Investors have bid up a narrow set of stocks that are either insulated from, or beneficiaries of, the crisis. Cyclical firms and firms directly impacted by the pandemic have languished. The chart below shows that only 24% of stocks in the S&P 500 are above their 200-day moving average. This means 76% of stocks are still near their market lows where they fell in March.

Source: Barchart.com

As investors, we often say that “the market is not the economy.”

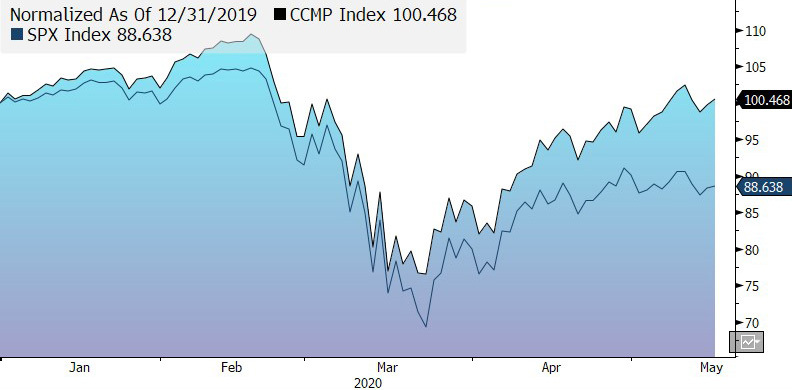

Stocks that have appreciated since March are typically financially strong companies that benefit from long-term secular trends that have accelerated with the pandemic. As we noted in our May 4th update, these companies tend to be asset light (meaning they have few capital assets relative to the value of the business), have recurring customer revenues, and are the beneficiaries of ongoing trends such as the digitization of commerce, network modernization, aging demographics, and data monetization. These types of firms tend to be clustered in the technology and healthcare sectors. Investors have shunned stocks most exposed to the pandemic, such as hotels and airlines, and have also avoided energy companies, industrials, and banks. This bifurcation is evident when we compare the performance of the technology-heavy NASDAQ index to the S&P 500. As the chart below shows, the NASDAQ (black line) has significantly outperformed the S&P 500 (blue line) since the market bottom and has almost fully rebounded from its losses.

Source: Bloomberg

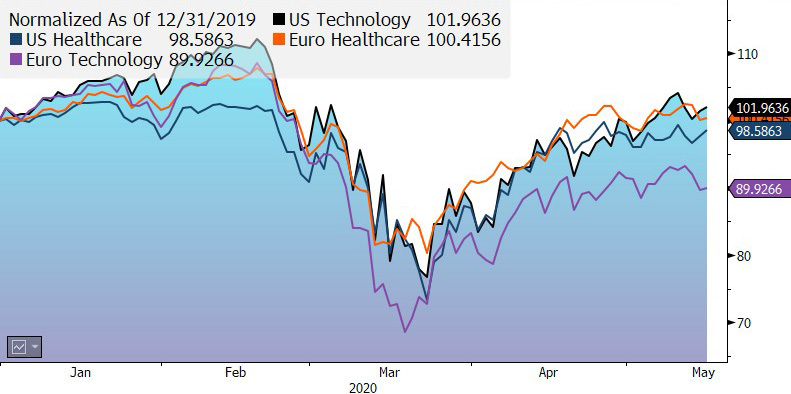

This bifurcation of stock market returns by type of company has happened around the world. In the chart below, we compare returns for owners of technology and healthcare stocks in both the U.S. and Europe. As you can see, U.S. and European healthcare stocks (blue and orange lines) are flat for the year. U.S. technology stocks (black line) are also flat for the year, and European technology stocks (purple line) have also rebounded sharply but are still down -10%.

Source: Bloomberg

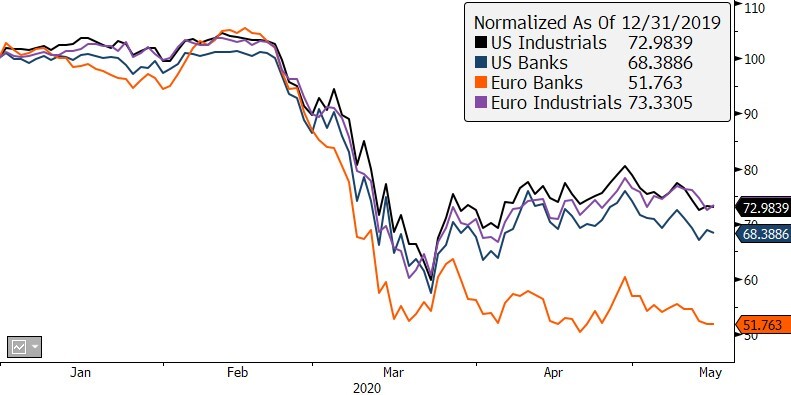

Compare this to the performance of industrial and financial companies in both the U.S. and Europe in the chart below.

Source: Bloomberg

Both U.S. and European industrial stocks are down -27% for the year (black and purple lines). U.S. bank stocks (blue line) are down -32% and European banks (orange line) declined just under -50%. When comparing the two charts, it is clear that sector selection matters. Most obviously, energy companies across the world face the same market dynamics regardless of domicile and both U.S. and European energy stocks have declined -39% for the year. We have had a longstanding underweight to energy stocks due to concerns about the effects of climate change. We have also been emphasizing a greater role for active management in all of our strategies.

Because the market is not the economy, the apparent disconnect between the stock and bond markets is not as substantial as it first appears. Investors are bidding up companies with strong balance sheets and underlying secular growth prospects. This has favored technology and healthcare stocks both in the U.S. and overseas, as well as a select group of other firms that also have strong balance sheets, a differentiated product offering, and underlying secular tailwinds. We believe investors must strike a balance between owning resilient companies at ever increasing valuations, and heavily-discounted firms that will likely outperform if the economy rebounds rapidly. We think the toll on the economy from the pandemic will be substantial. Therefore we remain inclined to favor the resilient firms, to the extent they can be identified. At the same time, however, we are underweight equities in general compared to long-term strategy targets, because valuations are not cheap for the types of companies we and our managers wish to hold for the long term.